Public markets: quarter-over-quarter the S&P 500 rose by 7%, and the Nasdaq composite declined by 1.0%. Year over year, the S&P 500 and Nasdaq declined by 19.4% and 33.1%, respectively. Thus in Q4, the S&P and Nasdaq began to show signs of stabilization relative to the rapid declines in the first three quarters of the year (see Chart “2022 Quarter by Quarter Performance”).

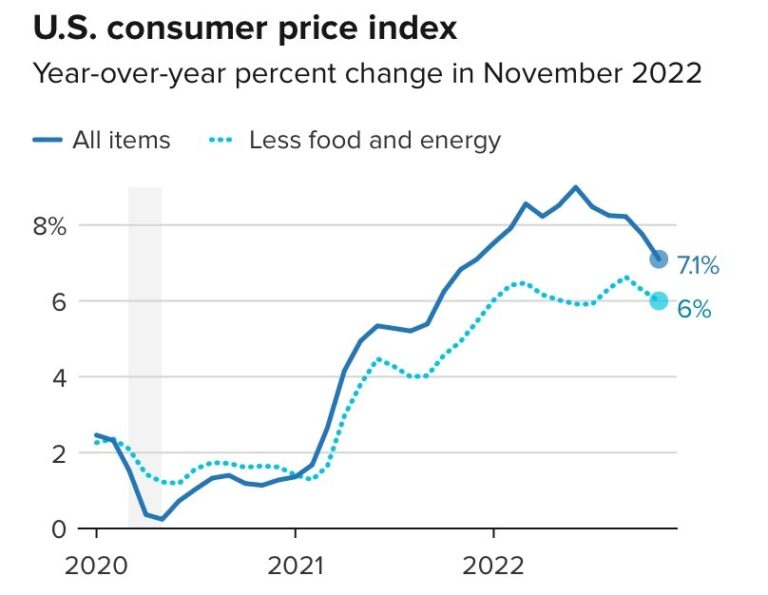

Why a calmer Q4: a major driver behind the market stabilization – inflation has abated (see Chart “U.S. Consumer Price Index”), and the market is beginning to price in the end of Fed hiking cycle leading to a retracement in yields across the Treasury curve from peak levels seen in Q3 2022. The Treasury yield curve at every maturity retreated (especially the 10-year yield and the 2-year yield). Starting in Q4, various inflation measures (e.g., CPI, PCE, as well as other market-based measures) have shown a few months of consecutive declines and established a downward trend – a key feature central to the Fed’s decision-making framework. Some inflation measures like the December CPI have fallen faster than consensus estimates – another welcoming sign the worst of inflation is behind us.

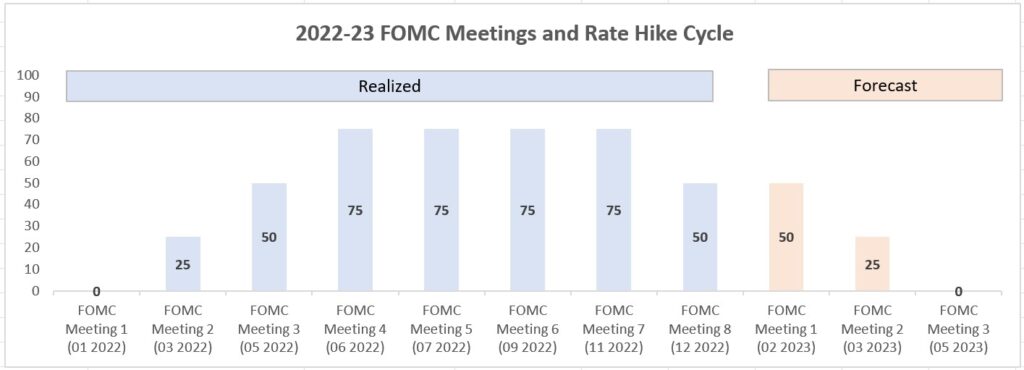

December 2022 FOMC meeting: consistent with these US economics development, the Fed raised rates by 50 bps (a slower pace than the previous 75 bps and the slowest pace in five meetings). If we look at the 2nd derivative here, the pace of Fed rate hikes has decelerated. Both the market and the Fed seem to think the Fed is likely at the 8th inning of this rate hiking cycle. With a few more rate hikes in 2023, the Fed will likely pause (see Chart “2022-23 FOMC Meetings and Rate Hike Cycle”).

The market is forward looking: the market is looking ahead 6-12 months and is pricing in the scenario that the Fed will begin to pause and even cut rates in the latter part of 2023 to early part of 2024. The risk-free rate and equity valuations are inversely correlated. A Fed pause and cut (called a Fed pivot) would lead to the start of the next bull market. So the equity market began finding some life this past quarter.

Valuation multiples: the public equity market is trading not too far from fair value multiples from a price to earnings perspective relative to the current level of the risk-free rate.

Next leg for markets to find a bottom: the other side of the stock prices – earnings and revenue growth rate – have not seen as swift and complete a correction as the valuation multiple side. Many corporations are just beginning to re-adjust their earnings and growth estimates for 2023 – as we’re now in 2023 – which will be about the time when the bulk of the Fed policy’s impact flow through the economy, businesses, and consumers. But starting with 2023 Q1 earnings season, both earnings and growth forecasts should re-adjust to realities and that would be in our view when the market finds a footing between the last market cycle and the upcoming one.

Outlook: towards the 2nd half of 2023 should be a recovery year for the S&P 500 and Nasdaq. (Fact: since 1945, the % of times the following year is a positive after the prior year is a negative in the S&P 500 is 81%). Private markets lag public markets in performance by a few quarters, so private companies that persist through 2023 should come out stronger on the other side.